Gender Data in Financial Inclusion

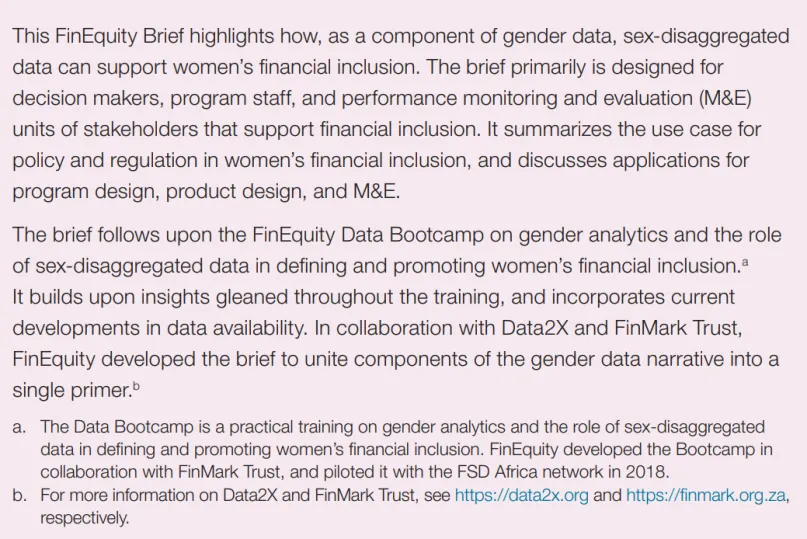

Making the Case for Gender Data in Financial Inclusion

At 7 percentage points, the global gender gap in account ownership has remained unchanged since 2011 (IFC 2017). An estimated $1.7 trillion finance gap also continues to exist for women-owned micro, small, and medium enterprises (MSMEs) in emerging economies (IFC 2017). This brief provides an overview of how gender data collection and analysis can narrow these gaps and enable key stakeholders to achieve their full potential in serving women. Collecting financial inclusion gender data is a key step in gender analysis. Analyzing how gender relations affect development outcomes is essential for uncovering:

- Who is excluded.

- Which financial products are used, and by whom.

- The impacts of financial inclusion interventions on development.

- How women’s financial needs differ from men’s.

- Why products need to be accordingly adapted.

The Current Availability of Gender Data

Demand-side data and supply-side data are complementary in the context of financial inclusion. Taken together, they provide an overall picture of the state of financial inclusion. When disaggregated by sex, they deliver information on the level and nature of women’s inclusion in the financial system. This, in turn, serves as an evidence base to inform financial inclusion policies and products.

- Financial inclusion demand-side data primarily are collected directly from users and potential users of financial services through surveys and focus groups. Most available demand-side data capture information on how people save, borrow, make payments, and manage risk. The data also provide important information about individuals who receive financial services—even through informal channels—and those who demand but are unable to access financial products.

- Financial inclusion supply-side data are derived from financial services providers (FSPs) (i.e., banks, insurers, and other financial institutions, including fintech providers). These data are based on completed transactions and other transactions or operations that can be documented through an FSP’s administrative data. The data offer information that illustrates access, use, quality, and other characteristics of the credit or savings products used. Supply-side data capture formal financial inclusion services, and, in some countries, semiformal financial services as well.

Data are generated and captured at three levels:

- Globally—through cross-country surveys, and by international organizations and global FSPs.

- Regionally—through cross-country surveys, and by development financial institutions and regional FSPs.

- Nationally—by regulators, government entities, and national FSPs.

A list of publicly available sex-disaggregated financial inclusion data sets can be found in the Annex.

DATA AVAILABILITY: CHALLENGES AND OPPORTUNITIES

The call for stronger demand-side data emerged around 2010, when numerous regulators began to develop national financial inclusion strategies and saw the need for more nuanced data to set targets and measure progress. By 2016, 79 percent of Alliance for Financial Inclusion members reported collecting some form of supply-side or demand-side sex-disaggregated data (AFI 2017). On the demand side, the World Bank Global Findex disaggregates data by sex to provide a global topline view of women’s financial inclusion. Many national-level demand-side surveys, such as FinScope, include basic demographic data (e.g., sex) and offer regulators a more nuanced measure of national progress.

However, challenges persist with collection and availability of relevant financial inclusion gender data. First, due to capacity challenges and funding limitations, surveys are not regularly conducted. Second, while FinScope data cover a number of countries, they are commissioned in a way that does not allow for cross-country comparison. Third, a lack of awareness of the value and importance of gender data within FSPs is a core supply-side challenge. Many FSPs see their policies and products as gender neutral—which can mask passive discrimination and exclusion of women. The perception can be further hampered by a lack of gender data collection that confirms or denies gender gaps in FSP portfolios.

At many financial institutions, IT and management systems or processes currently are not set up to collect or collate gender-disaggregated data and may require extensive retrofitting. FSPs, for example, often collect data by account rather than by individual. Even when available, gender data may not be based on commonly agreed-upon standards, such as what exactly constitutes a woman-owned enterprise. Quality issues may also exist due to errors and omissions in data input.

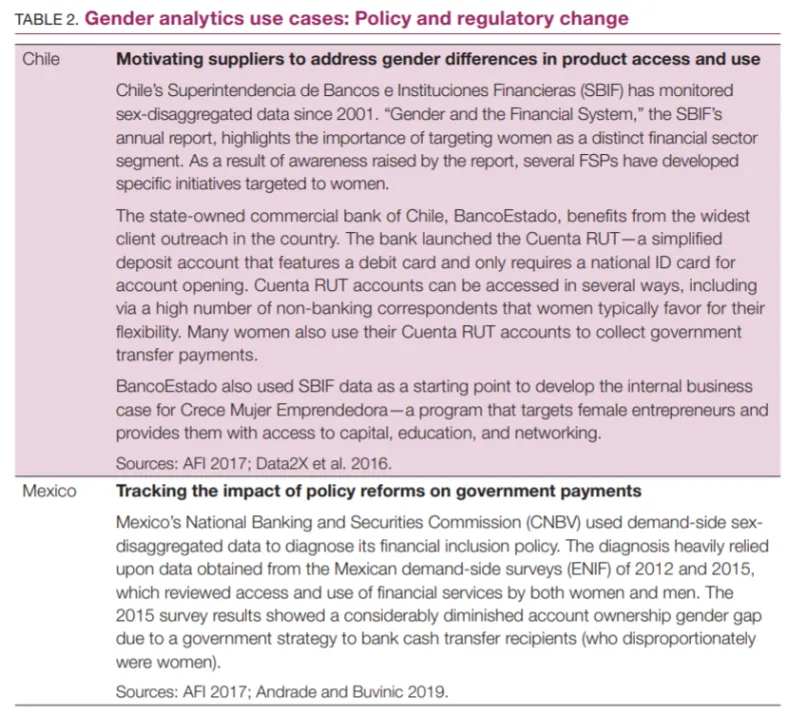

While significant challenges exist in data availability and use, growth in key data sets (e.g., the World Bank Global Findex, FinScope, the International Monetary Fund’s Financial Access Survey) and surveys by other institutions has increased the availability and use of gender data on access to financial services (e.g., savings, digital payment methods, insurance). In parallel, countries including Chile, Mexico, and Rwanda lead the way in robust national demand-side and supply-side data collection and analysis for women’s financial inclusion. Initiatives such as the Data2X Women’s Financial Inclusion Data Partnership work to make gender data central to multi-level efforts to close the gender gap in financial inclusion. The partnership encourages pilot testing and documenting best practices, sharing learnings and highlighting advocacy, and raising awareness and providing communications.

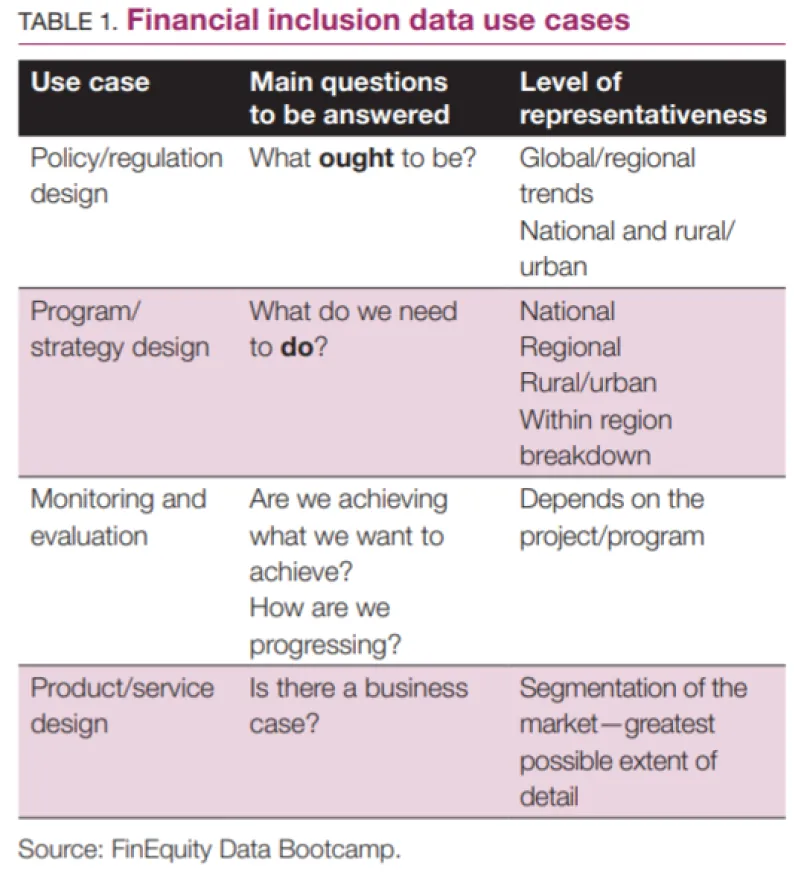

Key Use Cases for Gender Data

From a policy maker’s perspective it is necessary to establish a baseline by collecting, aggregating, and analyzing gender data at the national level. A baseline enables evidence-based policy-making and effective monitoring of progress against concrete targets. Moving forward from the baseline, it is optimal to obtain ever more granular sex-disaggregated data on the demand side and the supply side. For example, obtaining data on how many men and women are reached—by channel and product, broken down by age and location, and tracked over time—could lead to targeted policy-making that supports development and private-sector actors in serving the market.

Financial institutions that collect and analyze data by sex develop a more accurate picture of the market opportunity for serving women. They also build a better business case for developing products and services tailored to women’s needs. In addition, FSPs that launch or maintain a segmented women’s market program can benefit from understanding its impact on their bottom line (Data2X and Financial Alliance for Women 2020). Tracking sex-disaggregated data within a particular customer base can identify program strengths and areas for improvement, and link program performance to staff incentives (Data2X, Global Banking Alliance for Women, and the Inter-American Development Bank 2016).

For implementing organizations with financial inclusion programs, gender data are essential for designing, monitoring, and evaluating interventions that support women’s financial inclusion. Gender data can clarify an intervention’s mandate, diagnose a situation, and establish a baseline for women’s financial inclusion. The data also help organizations to set key targets, define implementation activities, and develop key indicators for measuring success.

USING GENDER DATA TO SHAPE POLICY AND REGULATION

Collecting and analyzing sex-disaggregated data can inform policy and regulation in evidence-based financial inclusion and enhance the effectiveness of national-level efforts. Examples of specific use cases can be found in Table 2 (below). In the context of financial inclusion policy-making, both supply-side data collected from FSPs and demand-side data collected through national-level financial inclusion surveys are essential.

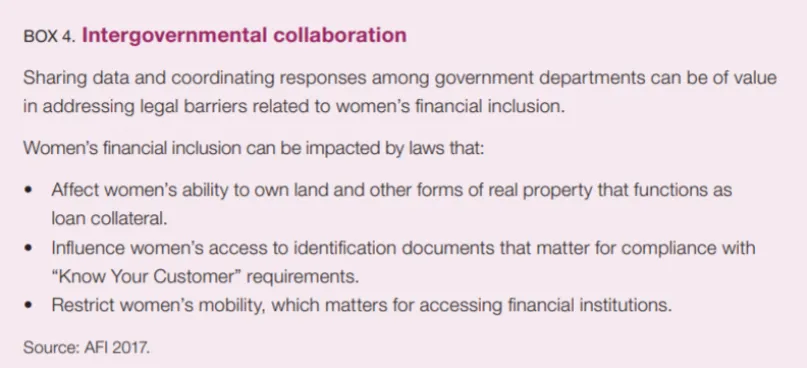

To obtain a comprehensive understanding of the supply side, key stakeholders must ramp up capacity building and coordinate data collection with a wide variety of FSPs, including banks, insurance companies, mobile network operators, mobile money providers, postal networks, and microfinance institutions.

Credit rating agencies and credit bureaus should also collect sex-disaggregated credit data (AFI 2017). Their efforts must consider national regulations on customer privacy, which may influence what can and cannot be requested or reported on a sex-disaggregated basis.

Collecting and analyzing this type of data requires an investment in time and financial resources, followed by iterations on processes and procedures. These actions are essential to creating policies and regulations that close the gap on women’s financial inclusion. The data unlock answers to vital questions, such as:

- Do patterns of exclusion signal constraints faced by specific segments of women (e.g., widows, divorced women, women in certain age groups)?

- Do other dimensions of social exclusion (e.g., race, ethnicity, disability, religion, caste) impact women’s access to services and assets?

- What constraints and challenges do respondents cite for exclusion (e.g., distance to access points, the digital divide, lack of collateral, lack of identification)?

- Which policies, laws, or regulations relate to constraints women have identified (e.g., property rights, ownership, regulations on land registration, business and employment registration, movable asset registry, universal IDs)? To what extent can they be changed through policy-making that is driven by the efforts of financial sector actors alone? Do changes require coordination with other ministries and stakeholders?

- Do the data reflect a lack of implementation of existing laws and regulations (de facto law) that needs to be targeted? Or a prevalence of customary law or social expectations and practices that hinder women’s access to and use of financial services?

- Do women possess information about their legal rights and recourse mechanisms around financial services?

USING GENDER DATA TO DESIGN TAILORED FINANCIAL PRODUCTS AND SERVICES

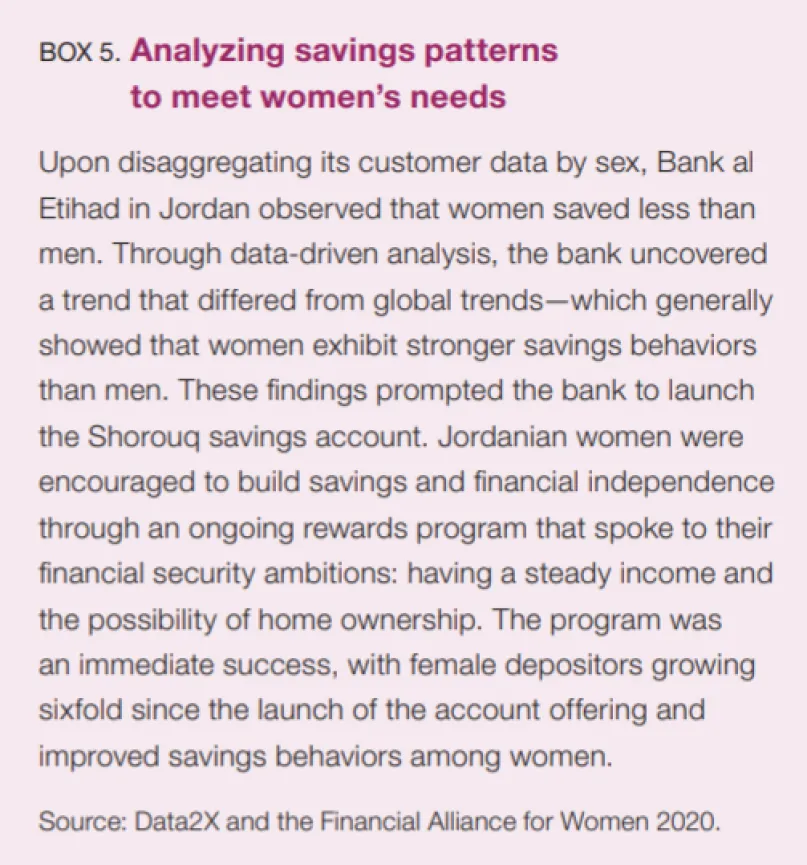

When financial institutions collect and analyze gender data, they can create a fuller picture of the market opportunity and build the business case for developing tailored products and services that meet women’s needs. Gender data can help FSPs to:

- Find new market opportunities,

- Develop a strategic rationale, and

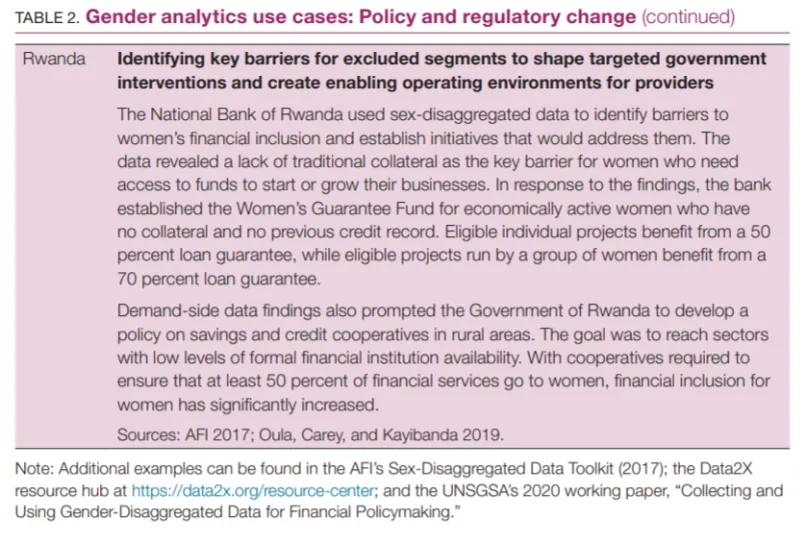

- Track the performance and profitability of products and programs, thereby supporting sustainable business strategies for the women’s market (Data2X and the Financial Alliance for Women 2020). Quantitative supply-side and demand-side data are required to understand various female customer segments. Supply-side data can show how many women access and use specific products and highlight existing gaps. Demand-side data can show why women do or do not use certain products, and how they use them. Alongside quantitative data, collecting and analyzing qualitative data is essential to further unpack gender differences and delve deeper into women’s needs, preferences, and financial behaviors.

Gender data analysis often reveals distinct financial behaviors and needs among women. These insights present opportunities for FSPs to design products and channels that better serve women. Findings have shown that, on average:

- Women are loyal customers. Despite being substantially underbanked, on average women use almost as many financial products as men.

- Women tend to be strong savers, with lower loan-to-deposit ratios than men.

- Women are prudent borrowers. Globally, nonperforming loans are low across all female segments.

- Women borrow significantly less than men, and their average loan size is lower than men’s.

- Women entrepreneurs prefer to be debt-free, and often are undercapitalize from the start.

- Women-led enterprises collect less than 3 percent of all global venture capital (Data2X and BNY Mellon 2019).

- When women select a new FSP, they prioritize security of personal and financial information.

As previously noted, significant challenges exist despite an increased understanding of the value of sex-disaggregated financial inclusion data. Supply-side sex-disaggregated data largely is still unavailable. This limits the ability of FSPs to understand and quantify the opportunity for serving women and to develop solutions that target specific segments. The need also exists for more household-level or demand-side research, yet surveys and focus groups are often convened on a one-time basis rather than at regular intervals. Finally, there is the concern that even with access to sex-disaggregated data, financial institutions may not leverage information to design gender-smart solutions but instead create products that superficially target women. Offering women a pink checkbook, for example, does not substantively address their financial needs or provide real value.

Despite these challenges, FSPs can better leverage data already at their disposal by:

- Collecting a minimum set of information for a topline perspective on reaching women, including customer data on portfolios, savings, and products.

- Using workarounds such as titles to infer sex (e.g., Ms., Mrs., Mr.), without directly requesting such information from clients. It is crucial to note that these inferences may not reflect a client’s gender identity.

- Administering surveys to learn how many (and what kind of) products women use, why they do or do not use certain products, and what services they are interested in accessing.

USING GENDER DATA FOR PROGRAM DESIGN AND MONITORING AND EVALUATION

Financial inclusion gender data support the key steps of program design and implementation. They are especially important for identifying gaps and opportunities in women’s financial inclusion that a specific initiative or program can address; for use as baseline data; for setting key targets; and for monitoring and evaluation (M&E) activities. Analyzing relevant supply-side and demand-side financial inclusion data can answer key questions, such as:

- What constraints do women face in accessing or using specific financial products and services—from the perspective of product, legal/regulatory, financial capabilities, digital financial literacy, and social norms?

- Do gaps exist between account access (holding an account) and use of an account for financial transactions? Can dormancy patterns be discerned from the data?

- Do women have access to certain financial products over others?

- Do gaps exist in women’s uptake of digital financial services, where available?

Answers to these questions, combined with a clear mandate and available resources, can inform an intervention’s theory of change (ToC) and plans for monitoring and evaluation.

The role of M&E is to support effective project implementation (Are we doing things right?); to determine whether desired results are being achieved (Are we doing the right things?); and to contribute to the global knowledge base on the types of interventions that are most effective in promoting the well-being of women, their families, and their communities (Do we know what works best?) (Knowles 2015).

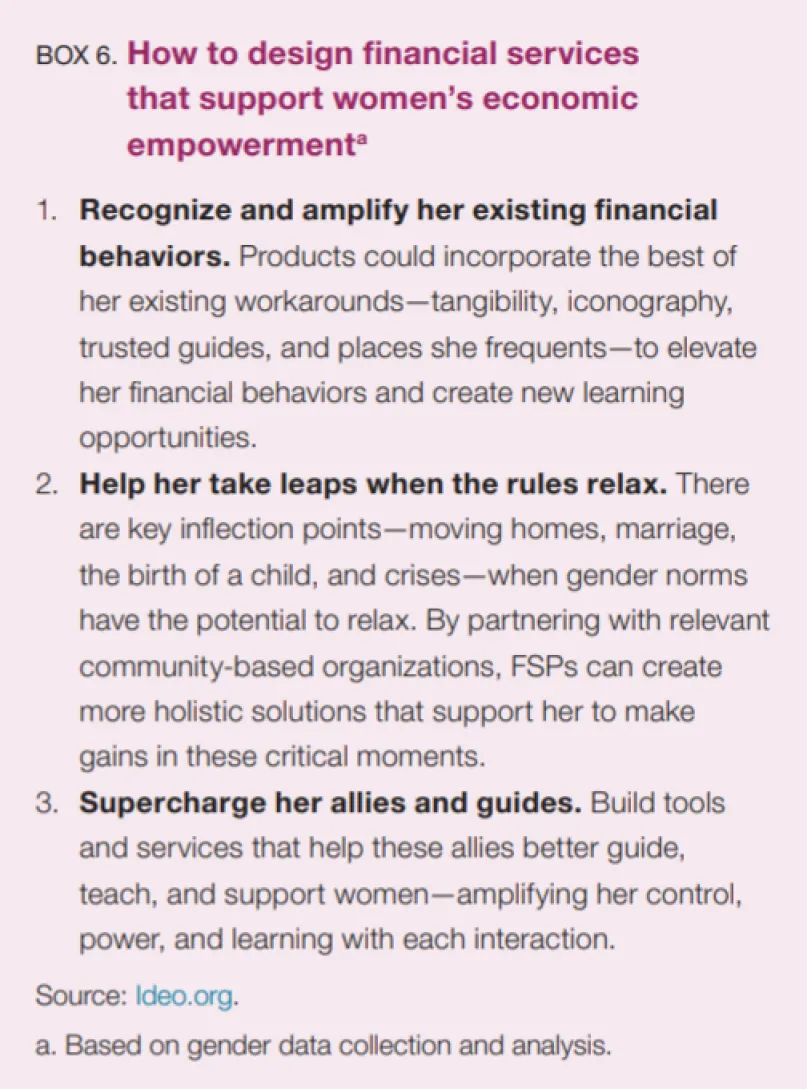

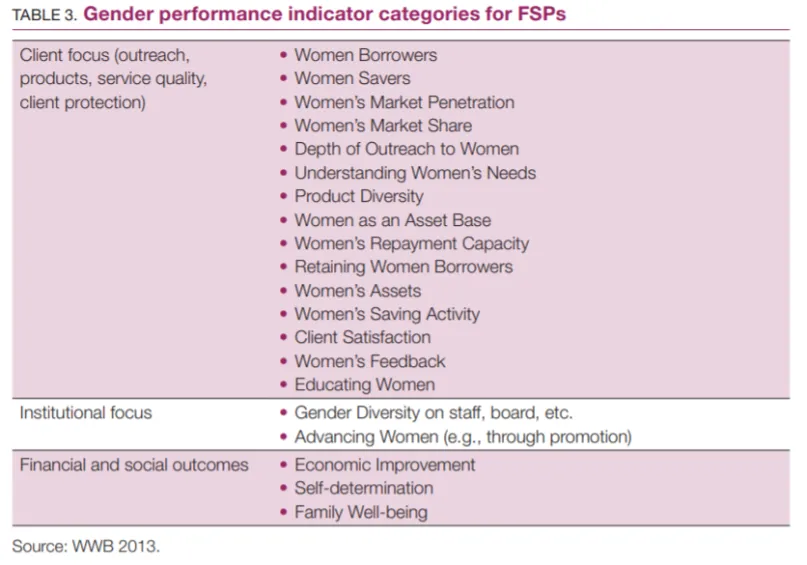

A critical step in developing an effective M&E framework is to identify indicators or variables that measure desired outcomes. As with a ToC, performance indicators reflect a program’s pathways and types of interventions. Developed by Women’s World Banking (WWB), Table 3 (below) provides indicator categories that can be used by financial institutions and stakeholders that support financial institutions in serving the women’s market.

It is important to note that in recent years, there has been widespread interest in expanding the measurement of women’s financial inclusion beyond traditional access and use metrics to include measures of women’s economic empowerment (WEE) (Golla et al. 2011). Women’s economic empowerment indicators measure a woman’s ability to economically succeed and advance, and the power she has to make and act on economic decisions. The three most common WEE domains are:

- Access. Gaining access to material, human, and social resources that enhance women’s ability to exercise choice, including knowledge, attitudes, and preferences.

- Ownership. Having ownership of resources and other productive assets.

- Agency. Increasing participation, voice, negotiation, and influence in decision-making about strategic life choices.

Some existing WEE measurement frameworks include time allocation (such as budgeting time for productive or domestic tasks), experience of gender-based violence, and gender norms and rules.

The application of WEE frameworks is not without its challenges. The term “empowerment” can be multidimensional and context-specific. While there is some consensus around the more tangible aspects of empowerment, such as increased asset ownership, there is less agreement around subjective measures like intrahousehold decision-making and bargaining power. As such, a core set of empowerment dimensions and indicators relevant to financial inclusion has yet to be developed.

Moving Forward

Robust, actionable data are essential to all stakeholders working to advance the goals of financial inclusion. Measuring who is included in—and excluded from—the financial system provides regulators and policy makers with a better understanding of policies needed to maximize inclusion. It gives them the tools to encourage the financial sector to move toward full and equitable access. From an FSP perspective, national-level supply-side and demand-side sex-disaggregated data deepen understanding of the market opportunity while qualitative data enable gender-sensitive product design. In addition, as international agencies and donors increasingly prioritize the gender dimensions of financial inclusion, sex-disaggregated data become indispensable for identifying gaps and opportunities for women’s financial inclusion.